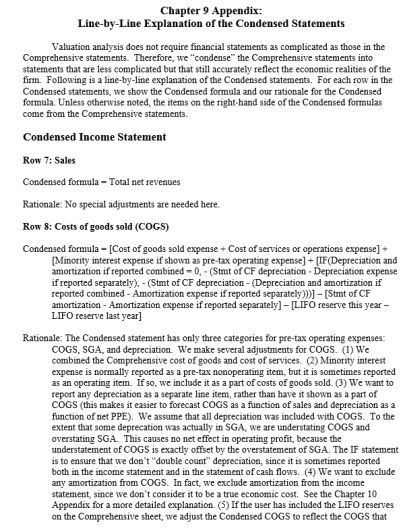

Amortization expense formula

In the example above the company. There is no specific formula for amortization.

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Operating income is a companys profit after subtracting operating expenses or the costs of running the daily.

. P Principal amount. The NPER function aids us to know the number of periods taken to repay. R Rate of interest.

However companies usually use the straight-line method to calculate amortization for. PMTrnp or in our. Amortization and depreciation are two methods of calculating the value for business assets over time.

Consider the following examples to better understand the calculation of amortization through the formula shown in the previous section. Straight Line Depreciation Method Cost of an Asset Residual ValueUseful life of an Asset. Diminishing Balance Method Cost of an Asset Rate of Depreciation100 Unit of Product.

Amortization Expense Recorded Cost Accumulated Amortization Book Value. Amortization calculation for a Vehicle Car. The general syntax of the formula is.

J3 max0 mineomonthj2 0 d3 1 - maxj2 c3f3d3-c31 g3g4. How to calculate Amortization. Depreciation Expense is very useful in finding the.

So here P. A rP n x 1 1 rn-nt The elements of the above formula for loan amortization are as below. One final consideration on depreciation and amortization expenses In strict terms amortization and depreciation are non-cash expenses.

Amortization is the practice of spreading an intangible. Assuming the titles in your example above start from A1 so this formula goes into cell G2. A Monthly payments.

After input copied to the right and down. The rate at which. Total Depreciation Expense 2 Straight Line Depreciation Percentage Book Value Relevance and Uses of Depreciation Expenses Formula.

NPER Rate PMT PV 3. How to calculate amortization expense. With the above information use the amortization expense formula to find the journal entry amount.

There is an equation built into Microsoft Excel that can really help you with calculating amortization. Initial value residual value. EBITDA Operating Income Depreciation Amortization.

The annual journal entry is a debit of 8000 to the amortization expense account and a credit of 8000 to the accumulated amortization account. Its called the PMT formula and it works when you input.

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

The Freedom Formula How To Turn 244 000 Into 1 4m In 14 Years Investing Architect Investing Debt Service The Freedom

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Accounting Equation Chart Cheat Sheet In 2022 Accounting Accounting Education Payroll Accounting

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Myeducator Accounting Education Accounting Accounting Classes

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Times Interest Earned Formula Advantages Limitations Accounting And Finance Financial Analysis Accounting Basics

Cash Flow From Operating Activities Learn Accounting Financial Analysis Accounting Education

Times Interest Earned Formula Advantages Limitations Accounting And Finance Financial Analysis Accounting Basics

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Pin On Investing Investment Clubs Taxes

Ebit Vs Ebitda Differences Example And More Bookkeeping Business Accounting Education Financial Analysis

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income