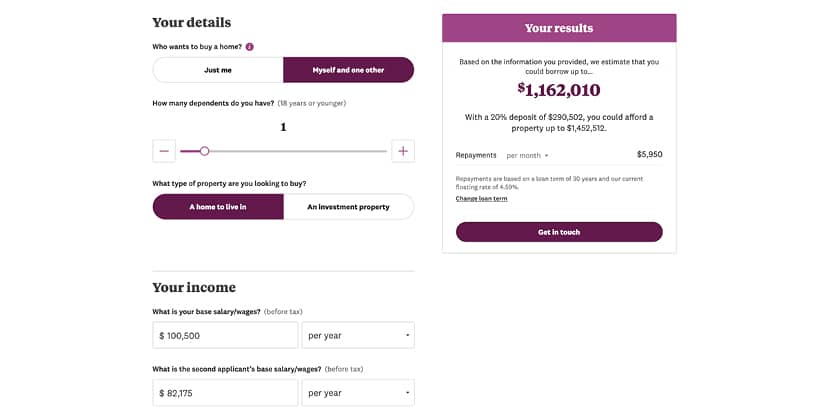

Investment property borrowing calculator

In most cases the interest is deducted when its paid and the borrowing costs are written off over several years. Borrowers are much less likely to walk away from a home loan particularly if the property is being used as a primary residence.

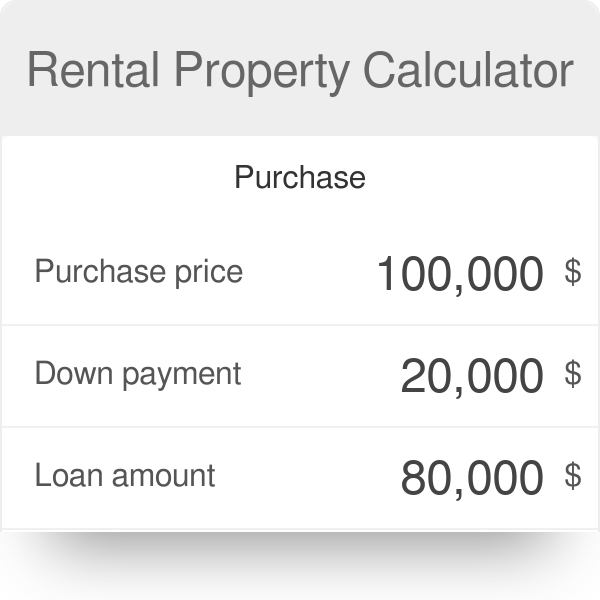

Rental Property Calculator Most Accurate Forecast

Using LendingTrees home loan calculator we crunched the numbers for a 30-year fixed-rate loan on a 250000 home with 20 down 50000.

. Although many factors among them the loan-to-value ratio and the policies of the lender youre dealing with can influence the terms of a loan on an investment property youll want to. This may pertain to expenses for a weekly cleaning service or having a property cleaned up after a tenant moves out. The more income you can prove you earn to a lender the greater your borrowing capacity is likely to be.

Capital values of products. The Reserve Bank of Australia RBA marked the first month of spring by launching its fourth consecutive outsized rate rise implementing a 50 basis point increase from the current rate of 185 per cent to 235 per cent the highest level in seven years. The calculator estimates the amount of cash you will require or receive on a monthly and annual basis to fund your investment property.

Is Negative Gearing A Good Investment. Stamp duty calculator. Borrowing power calculator.

2 examine your serviceability and predict when you can afford the next property. Ultimate Investment Property Calculator. After tax 3 Your expenses.

Undeveloped land on the other hand doesnt deliver the same degree of investment security for the. Its important to note the calculator assumes a fixed rate for the entire life of the loan. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre.

Compare how different interest rates loan terms and repayment frequency can. This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated. Sometimes people even use this phrase to describe buying a home they live in because after all that property is a big investment for them.

Best suburbs to invest in Queensland. This applies to investment products with risk rating of 4. Market interest rates example Interest rate for investment property example 1 unit.

The calculator also doesnt factor in interest rate fluctuations. 1 predict how a portfolio of multiple properties up to 16 properties will grow in value. 3 work out your expected income tax liability from year to.

The comparison rate for the ING Personal Loan is based on an unsecured loan of 30000 over a loan term of 5 years. Calculate the cost of your home loan repayments using our loan repayment calculator to find out how much you can afford to borrow. Residential property analyst Terry Ryder of Hotspotting is bullish on regional locations in Queensland calling them some of the best performers in the nation He names the Sunshine Coast Gold Coast Mackay Rockhampton Townsville and the Fraser Coast as locations for 2022.

If you receive any income from an investment property Other income. How your income and expenses can impact your borrowing power. Lets take a look at the key things you need to know about buying and financing investment.

It also gives an indication of the change in the amount of tax you will pay due to owning an investment property. Type of investment property. VIEW ALL CALCULATORS.

These two measures are then combined to provide a measure of the after tax profit or loss. Borrowing to invest is a medium to long term strategy at least five to ten years. He also likes the.

Different amounts and terms will result in different comparison rates. However whether this improves or adheres your borrowing power will depend on many things like whether the property is positively or negatively. Your investment property will definitely be considered when a lender assesses your borrowing power.

But investment property most commonly means buying a home that you dont live in but instead rent out. Different loans have different fees features and repayment options. Cleaning - Investment property owners can claim cleaning costs as an expense because it helps in generating an income.

Calculate your weekly profit or loss with our investment property calculator. Use our loan calculator to see how the numbers stack up between two loans. Interest rates are current as of.

Groceries petrol bills takeout gym or entertainment. It has announced a fifth consecutive rate hike following its monthly board meeting on Tuesday 6 September. Speak to our mortgage brokers by calling 1300 889 743 or fill in our free assessment form to find out if you can.

On Tuesday September 6th 2022 the average APR on a 30-year fixed-rate mortgage rose 1 basis point to 5990The average APR on a 15-year fixed-rate mortgage rose 1 basis point to 5250 and the. Once youve played out with the investment property calculator we can help you qualify for an investment loan to buy a new property. This comparison rate applies only to the example or examples given.

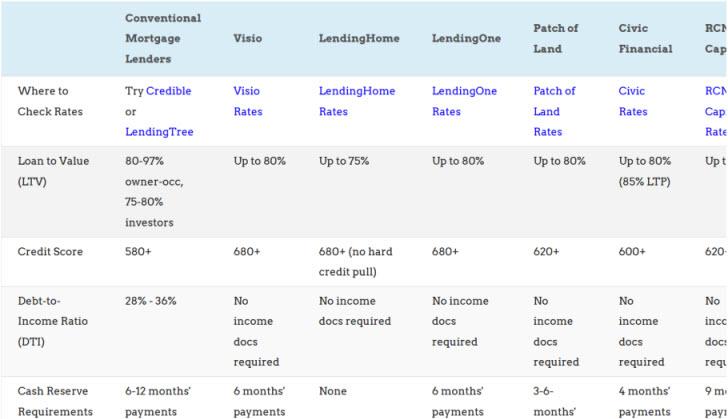

Learn how to apply for a loan and compare investment property mortgage rates. Your living expenses eg. Its typically done through margin loans for shares or investment property loans.

Use this calculator to work out how much a deferment also known as a pause or holiday will really cost you. The Ultimate Investment Property Calculator is a super model that many property investors dream. Higher risk means higher interest rates and stricter borrowing requirements.

Very High - youre generally comfortable with maximizing your return potential on investment coupled with maximized risk of investment loss. The interest and borrowing costs for your investment loan will be treated differently by the tax office. Loan comparison calculator.

The investment is usually the security for the loan. You understand the relationship between investment risk and reward and are comfortable with this level of fluctuation. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you.

A margin loan lets you borrow money to invest in shares exchange-traded-funds ETFs and managed funds. Discover the latest Australian property investment news and information for investors homebuyers and real estate professionals. Moreover a house on a lot has greater value on the open market and makes for a more secure form of collateral.

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

Car Loan Payment Calculator Estimate Monthly Payment Spreadsheet Car Loan Calculator Car Payment Calculator Car Loans

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Rental Property Calculator Most Accurate Forecast

5 Benefits Of Using A Personal Loan Emi Calculator Axis Bank Personal Loans Loan Axis Bank

Compare Investment Property Loans Rental Property Mortgage Rates

Irr Calculator Internal Rate Of Return With Dates Plus Npv

Rental Property Calculator Forecast Your Rental Property Roi

Rental Property Calculator Most Accurate Forecast

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

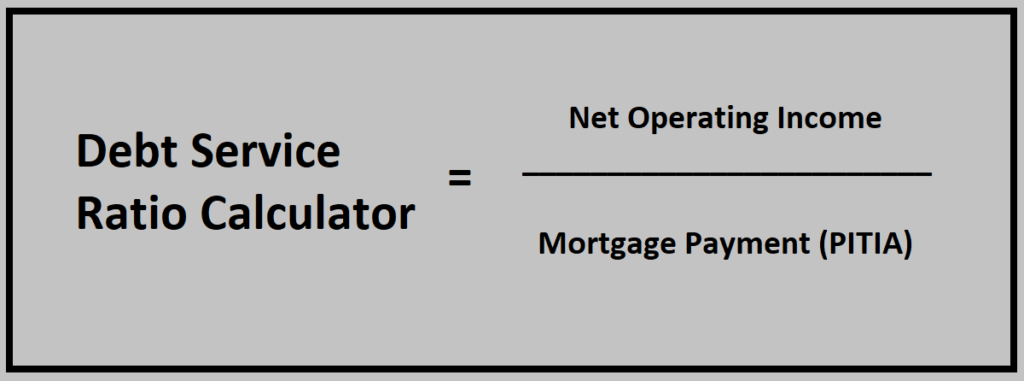

Dsr Loan For Investment Properties Debt Service Ratio Calculator

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator How To Calculate Roi

17 Clever Ways To Cover A Down Payment For An Investment Property

Rental Property Calculator Forecast Your Rental Property Roi

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World